36+ Should i borrow the maximum mortgage

What is my loan rate. It has since expanded its mandate to improve Canadians access to housing.

2

Conforming limits are adjusted every year by the FHFA.

. You can borrow a minimum of 5 and a maximum of 20 40 in London of the propertys full price. How much can I afford to borrow. No prepayment charges if the loan is paid after 36 months.

The organizations primary goals are to provide mortgage liquidity assist in affordable housing. Thats why you can find compare and apply for an insurance policy on RinggitPlus with just a few clicks. In exchange for allowing you to borrow this money your lender will charge you interest.

No maximum loan amount. The mortgage qualifier calculator steps you through the process of finding out how much you can borrow. Borrow from her 401k at an interest rate of 4.

In other words your mortgage payment shouldnt be. But it doesnt stop there. CLTV FOR RATE SHOWN 60 of your homes value.

How much will my loan payments be. A jumbo loan is meant for home buyers who need to borrow more than 647200 to purchase a home. MAXIMUM TERM FOR RATE SHOWN 5 Years.

Make sure to check their website to know the current loan limits. Although your age doesnt directly affect the interest rate it does affect the maximum amount you can borrow. Lenders use these ratios to figure out the maximum monthly mortgage payment you might qualify for.

28 percent and 36 percent. Should You Borrow From Private Mortgage Lenders. You can calculate your mortgage qualification based on income purchase price or total monthly payment.

DCU service for the life of the loan Well service your loan as long as you have itNo need to worry about making payments to a different lender. For example if your loan amount is 620000 your mortgage is considered a conforming conventional loan. And your back-end DTI ratio shouldnt exceed 36.

Fixed-Rate Home Equity Loans. Lifetime mortgage lenders assign a percentage release amount or Loan To Value for each plan by age. As a requirement you must make a 5.

Our experienced loan experts will help you determine how much house you can afford and check if you qualify for one of our zero-down loans with no private mortgage insurance PMI. Simply put it is the maximum amount that your insurer will pay you. The 52-week high rate for a VA fixed mortgage rate was 536 and the 52-week low was 458.

Continental baseline is 647200. This ratio says that your monthly mortgage costs which includes property taxes and homeowners insurance should be no more than 36 of your gross monthly income and your. Mortgage programs that fit your needs with DCU service for the life of your loan.

The rule states that your mortgage should be no more than 28 percent of your total monthly gross income and no more than 36 percent of your total debt. Canada Mortgage and Housing Corporation CMHC is a Crown Corporation of the Government of Canada. Maximum is 50 with compensating factors Most lenders accept 43 Should Ideally.

Own a property because mortgage lenders need to know that your home or property is protected against major risks. A mortgage is an arrangement where you borrow money from a lender to buy a property whether as a home or investment such as a buy-to-let. It was originally established after World War II to help returning war veterans find housing.

Ally Bank customers also take an average of 36 days to close on their home. Using a percentage of your income can help determine how much house you can affordFor example the 2836 rule may help you decide how much to spend on a home. For manually underwritten loans Fannie Maes maximum total DTI ratio is 36 of the borrowers stable monthly income.

While you may have heard of using the 2836 rule to calculate affordability the correct DTI ratio that lenders will use to assess how much house you can afford is 3643. That would give him 1750 a month to put toward a housing payment. Applying for insurance should be hassle-free.

Should I consolidate my loans. Should Ideally be 36. Assuming a 30-year mortgage that amount of 630000 can then be used to gradually pay for his mortgage over the next 360 months.

How Much Mortgage Can I Afford if My Income Is 60000. The older that you are the higher the maximum equity release can be. Borrow from the bank at a real interest rate of.

Consistent payments Youll have the same principal and interest payment for the life of the loanFixed-Rate Home Equity loans are available in all 50 states. We also offer a 500 rebate on your closing costs. Every borrowers situation is different but there are at least two schools of thought on how much of your gross income should be allocated to your mortgage.

Her cost of double-taxation on the interest is 80 10000 loan x 4 interest x 20 tax rate. Multiply your annual salary by 036 percent then divide the total by 12. This is the maximum amount you can pay toward debts each month.

Calculate Please complete all fields Maximum loan of 750000 for an LTV rate between 75 and 80 Maximum loan of 1 million for an LTV rate between 70 and 75 Maximum loan of 15 million for an LTV rate between 65 and 70. Most lenders prefer 28. Subtract your other debts including your car payment your student loan payment and other debt payments from this amount to determine the maximum amount you can spend on your monthly mortgage payment.

Mortgage Payment Protection Insurance MPPI MPPI provides longer mortgage protection for 12 months up to 2 years depending on your policy. Lenders subtract the mortgage balance from that amount to arrive at the maximum you can borrow. Maximum DTI Ratios.

Use our Buy To Let Mortgage calculator to give you an indication of how much we could lend your clients. No prepayment charges if 25 of the loan is paid after six months and within 36 months. The term of a mortgage usually lasts between 25 and 35 years.

Your insurance provider covers 125 of your mortgage. The usual rule of thumb is that you can afford a mortgage two to 25 times your income. The maximum amount you can borrow through this loan is Rs10 crore and the repayment can be done before the superannuation of non-pensionable salaried employees and extends up to 75 years for.

The usual limit is 80 percentor 100000 for a 125000 home 805125000. At 60000 thats a 120000 to 150000 mortgage. As of 2022 the maximum conforming limit for single-family homes throughout the US.

How much house can I afford. Most people need to borrow some amount of money in order to buy a houseand a mortgage can be part of a good investing strategy too. To determine the loan amount lenders use the loan-to-value ratio LTV which is a percentage of the appraisal value of your home.

The maximum can be exceeded up to 45 if the borrower meets the credit score and reserve requirements reflected in.

Pros And Cons Of Fha 203k Loan Free Business Card Design Fha 203k Loan Business Card Design

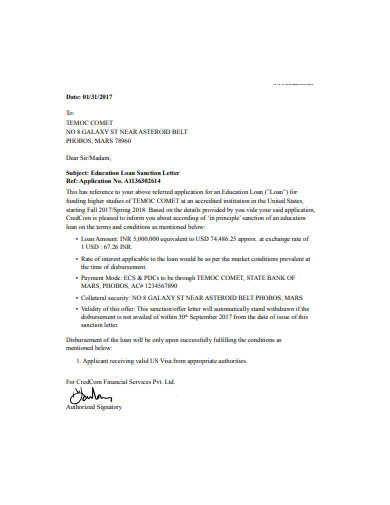

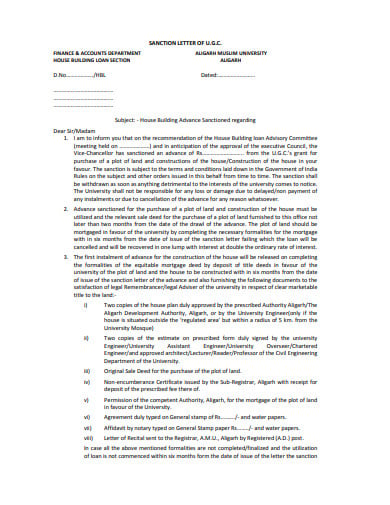

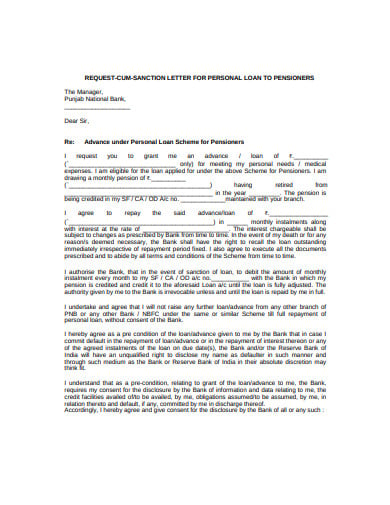

3 Loan Sanction Letter Templates In Google Docs Word Pages Pdf Free Premium Templates

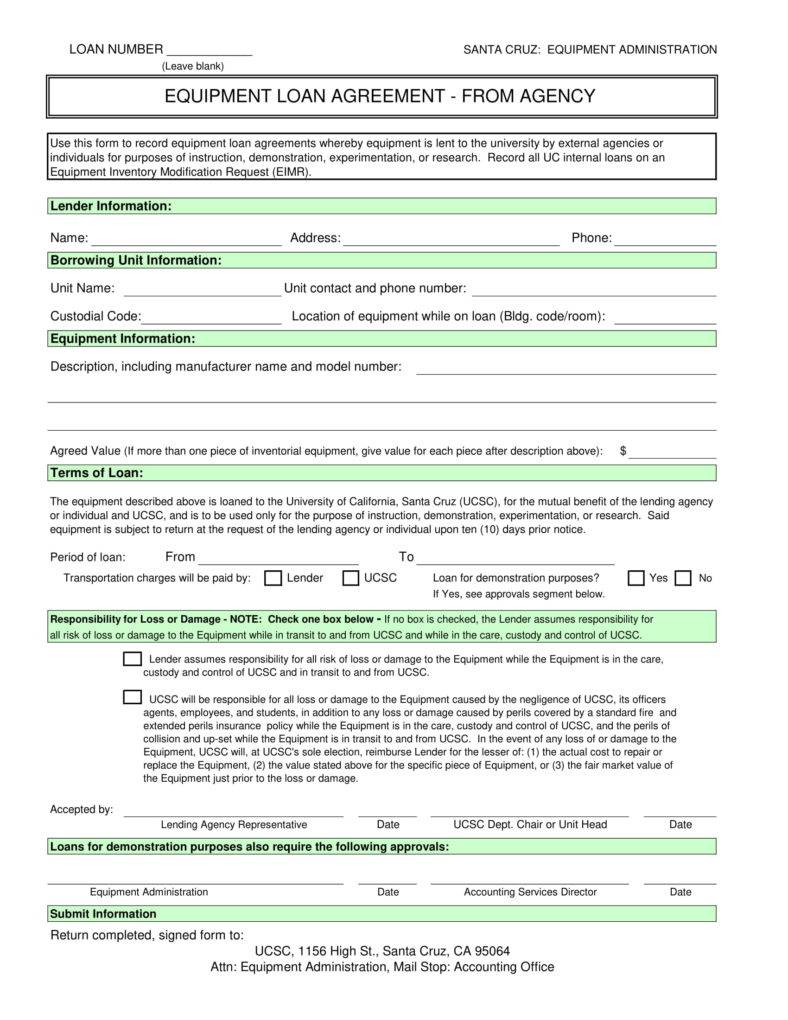

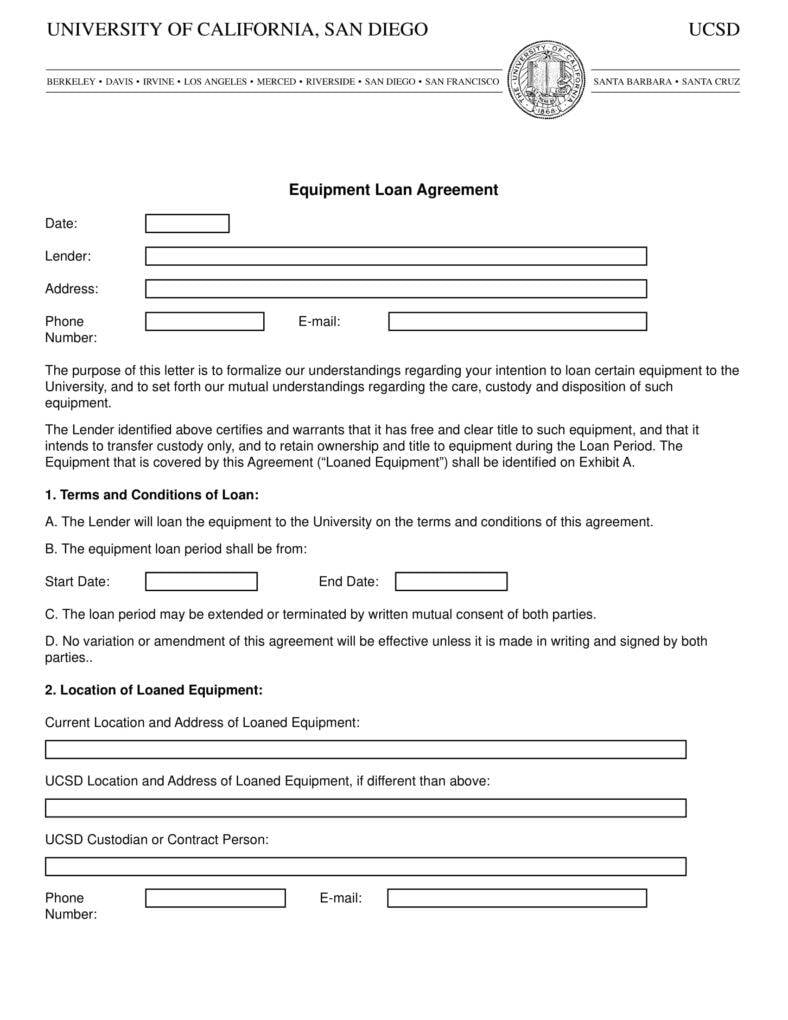

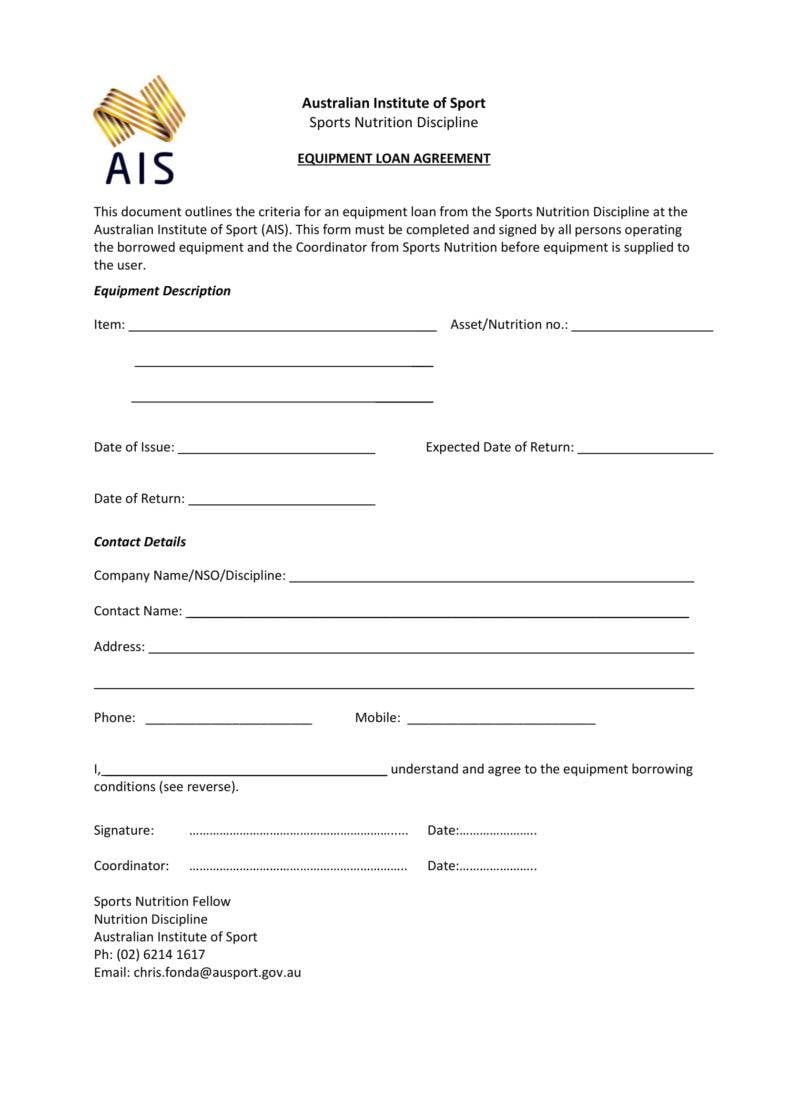

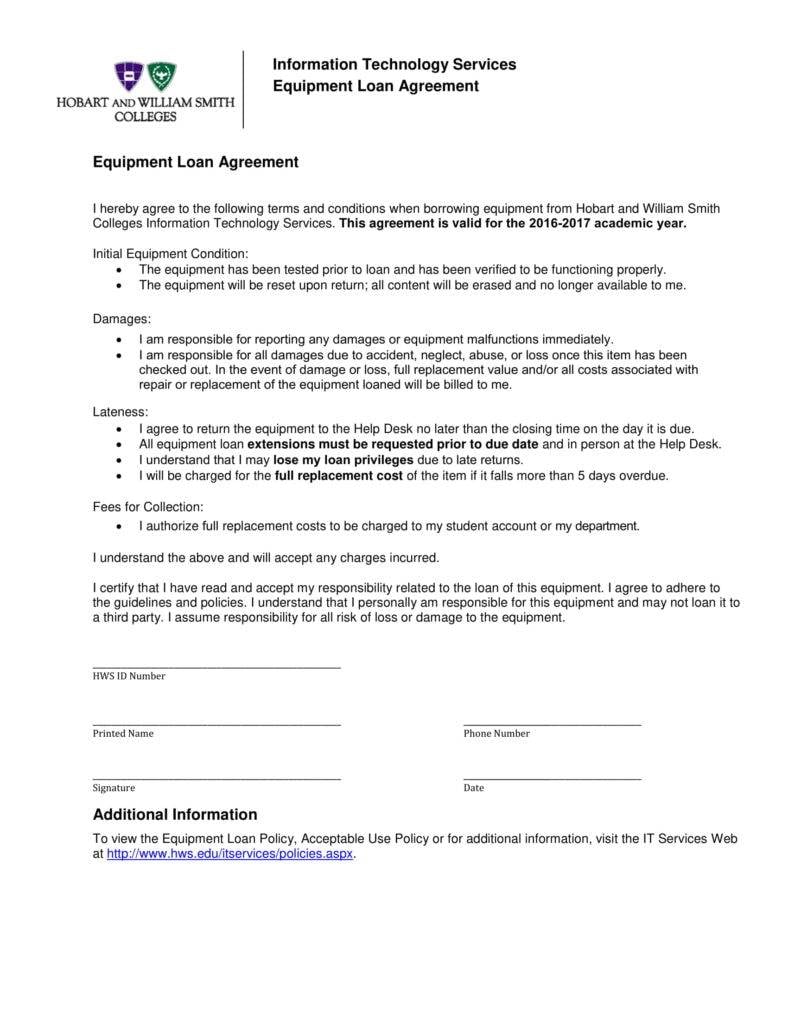

6 Equipment Loan Agreement Templates Pdf Word Free Premium Templates

3 Loan Sanction Letter Templates In Google Docs Word Pages Pdf Free Premium Templates

Free 5 Small Business Loan Proposal Samples In Ms Word Google Docs Apple Pages Pdf

Use Our Mortgagecalculator To Help You Set Your Budget Price Your Payments See How Making Additional Paym Home Buying Tips Mortgage Calculator Calculators

Bwsoeu 8pgnfjm

3 Loan Sanction Letter Templates In Google Docs Word Pages Pdf Free Premium Templates

36 Sample Letter Of Explanation Templates In Pdf Ms Word

Free 5 Small Business Loan Proposal Samples In Ms Word Google Docs Apple Pages Pdf

Fha Closing Cost Assistance For 2022 Fha Lenders In 2022 Fha Closing Costs Real Estate Tips

36 Sample Letter Of Explanation Templates In Pdf Ms Word

Free 5 Small Business Loan Proposal Samples In Ms Word Google Docs Apple Pages Pdf

3 Loan Sanction Letter Templates In Google Docs Word Pages Pdf Free Premium Templates

6 Equipment Loan Agreement Templates Pdf Word Free Premium Templates

6 Equipment Loan Agreement Templates Pdf Word Free Premium Templates

6 Equipment Loan Agreement Templates Pdf Word Free Premium Templates